What is Retiready?

Retiready is a retirement planning service from Aegon that can help you take control of your savings.

Retiready benefits

- View and monitor your savings value at any time

- Easy planning tools

- Control over your savings – make changes whenever you need to

- Personalised retirement readiness score – so you know how prepared you are

Getting the full picture

Retiready is a free digital planning service from Aegon. Retiready allows you to take control of your planning so you can track your savings and goals in one place. Having the tools to view your plans together gives you a chance to focus on your bigger picture.

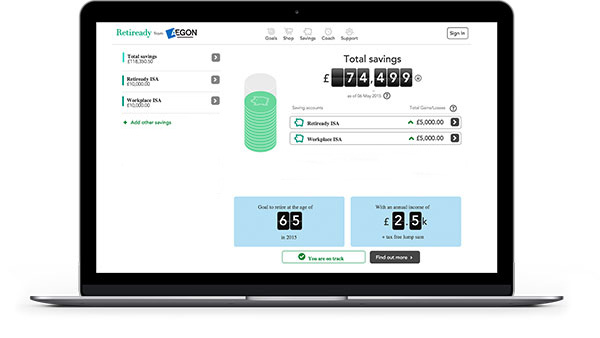

Retiready score

Our unique Retiready score helps you understand if you're on track with your savings expectations. Answer a few simple questions and we'll give you a score that shows you how close you are to the retirement you want. Based on your score, we can support you with a plan to work towards your savings goals.

Your savings goals

To successfully plan your savings goal, you'll need to understand where you are now. Our dashboard provides you with your forecast, your goals, your goal tracker and breakdown so you always know where you stand. You can unlock our lifestyle planning tools by getting your free Retiready score.

Aegon - a name you can trust

Our story started over 190 years ago, when we were founded as Scottish Equitable right here in the UK. Today, we're part of Aegon - a global financial services company. We're always evolving to help people save towards their future and to make sure we're there for them when they need us most. That's why our purpose is to help our customers live their best lives.

Being the UK's largest investment platform provider, we provide pensions, savings and investment solutions to customers. We do that by partnering with financial advisers and providing workplace pension schemes to employers.