Retiready aims to help you learn more about your pension savings and how to plan for your future.

You can manage your pension savings by signing in to Retiready. It's easy to use, lets you view what your workplace pension is worth today, and what you can aim to get from your retirement.

It also allows you to consider whether you should transfer other pensions so you can see everything in one place.

We've made getting on track for your retirement easy

Your Retiready Score is a number out of 100 that tells you how on track you are to getting the retirement you want.

Getting your score is easy – all you need to do is type in some details of your current retirement plans – like how much you have in savings and any contributions you or your employer make. Then tell us what income you’d like in retirement and Retiready will give you your score.

It only takes a few minutes and no matter what your score is, Retiready has all the tools you need to help you understand what to do to make it even better.

It's your money, no matter what

When you’re planning your retirement savings, it’s good to know if you’ve covered all bases.

Our Why save in a workplace scheme article might give you some things to think about.

It’s your pension and yours to keep whatever happens – even if you change jobs. So make sure we always have your most up-to-date contact details so we can keep in touch.

Bringing your savings together

You may have a few different pension plans, either from previous employers or personal ones. Keeping track of them all can be tricky, so combining your pension plans might be something you want to consider.

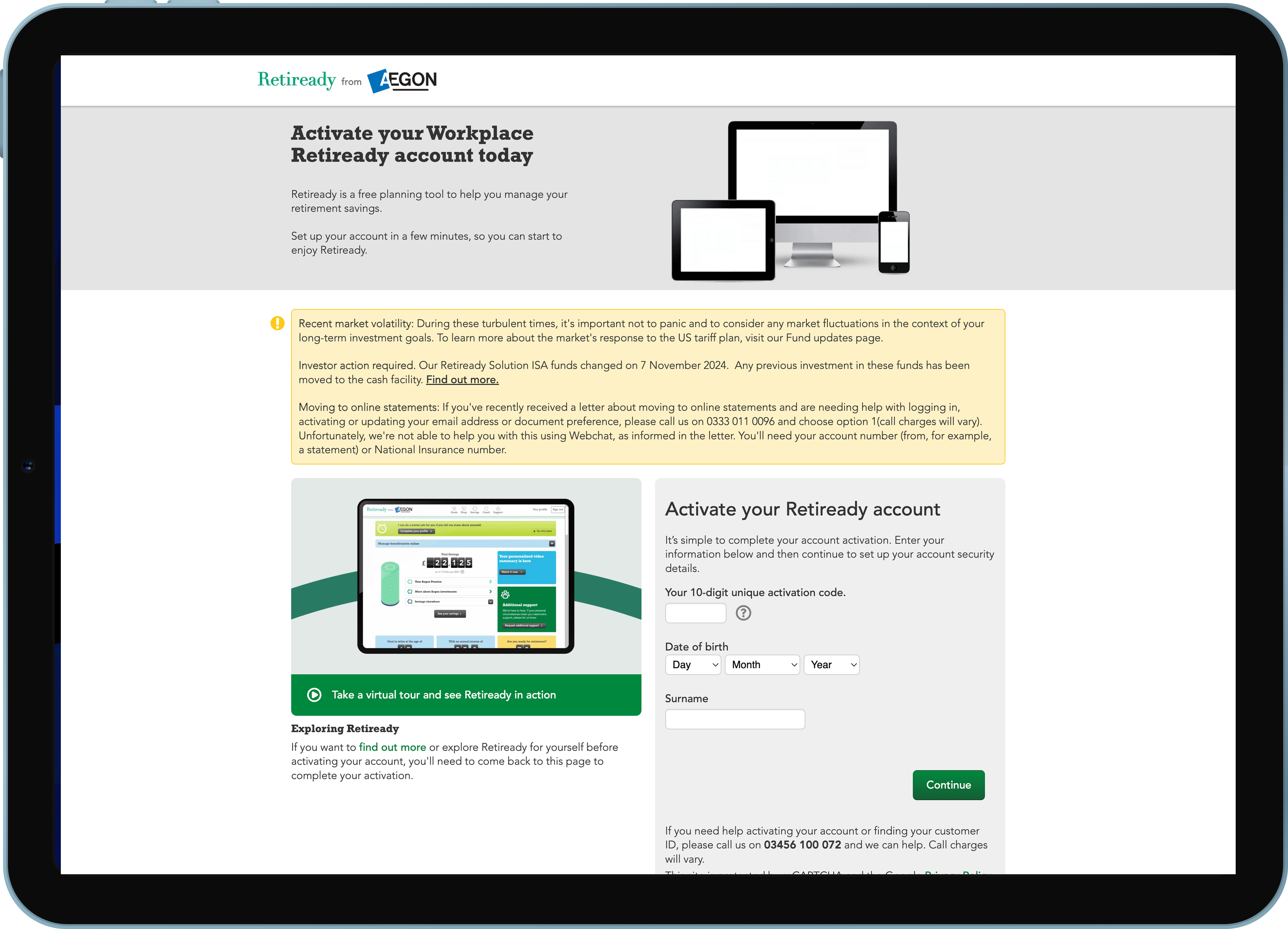

Activate your account to access our tools

It's quick and easy to activate your Retiready account, you'll just need the customer ID we sent you, or if you need a reminder get in touch. You can also access our planning calculators and tools.