Flexi-access drawdown lets you keep your money invested while giving you access to take an income and/or lump sums from your pension pot when you need to. As the name suggests, it can give you flexibility over how you take your pension benefits.

Understand your options

Back to previous pageFlexi-access drawdown

How it works

With flexi-access drawdown you keep your money invested, choosing investments that suit your risk appetite. For advice on whether a fund or investment is suitable for you, please speak to a financial adviser. There may be a charge for this.

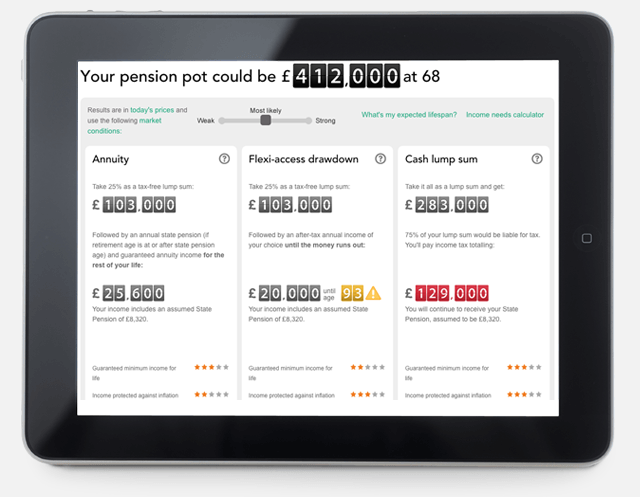

You can take a regular income and/or one-off cash payment from your investments to suit your needs and yearly income tax position. This gives you the control to start, stop or vary your income and cash payments. When you take any of your pension benefits, you may be able to take up to 25% of your pension pot as a tax-free lump sum, and choose for the remainder to go into a flexi-access drawdown account.

Flexi-access drawdown:

- When you first take any taxable income (regular or single amounts) from your flexi-access drawdown account, it triggers a reduction in the amount you can pay each year into money purchase pensions without incurring a tax charge (£10,000 for the current tax year). (Note that any tax-free cash lump sum you take when you first designate funds for flexi-access drawdown does not trigger this reduction.)

- Is a more involved option than an annuity as you need to take an active role in managing your pension.

- Can pay death benefits from any remaining funds after your death.

- Unless it comes with a guarantee, you can't be certain that your money will last to the end of your lifetime and the value of the drawdown account can be affected by investment performance.

- Regular income and one-off lump sums paid from your flexi-access drawdown account are taxed as income.

- Can be a more complex option - you may want to get financial advice before you apply.

Investment Pathways

Following the Pensions Freedom Act in 2015, the Financial Conduct Authority (FCA) has set out new rules to help unadvised customers in drawdown. As part of the retirement outcomes review, the FCA has introduced four Investment Pathways to help make retirement choices simpler.

You'll be able to choose from four tailor-made options and select the type of fund that's best suited to your retirement needs.

Whether you choose to leave your money where it is or begin to take an income, you can review your retirement options at any time and choose to switch funds without any penalties.

You can review your options under the drawdown section of your Retiready dashboard, or if you're an Aegon & Scottish Equitable Pensions and Bonds customer you can find more information in our support section. We've also created a help and support page if you'd like to find out more.

Things you should think about when taking flexi-access drawdown

- The level of income you take will need to be reviewed regularly – consider when and how you take your pension benefits.

- The income you receive may be lower or higher than you could receive from an annuity, depending on the performance of your investments.

- The rules governing how much income you can take may change. This could mean income drawdown no longer meets your requirements.

- Drawdown will reduce the size of your pension fund and the investment growth may not be sufficient to maintain the level of income you wish to draw. If you withdraw money at a rate greater than the growth achieved by your investments, your remaining fund will reduce in value. The level of income you take will need to be reviewed if the fund becomes too small - this is more likely the higher the level of income you take.

- Consider the amount of tax you'll have to pay on any regular income or one-off lump sum payments taken from your flexi-access drawdown account.

- This information is based on our understanding of current taxation law and HM Revenue & Customs' practice, which may change.

Is flexi-access drawdown right for you?

Create an income plan for retirement

Find out which retirement option best suits your circumstances and fits with your goals. Use our interactive tool to view, combine and adjust your options.